Quick answer: Republican economic policy focuses on faster growth, work incentives, and disciplined spending. The approach lowers barriers to investment, simplifies taxes, and streamlines regulation so businesses hire, produce, and pay more. It also backs infrastructure with clear returns and private participation. To address debt, it restrains spending growth and modernizes major programs while keeping pro-growth incentives in place. Evidence from 2019 income gains, official tax tables, and long-term budget outlooks supports this strategy. Census.gov+2JCT+2

Why growth comes first

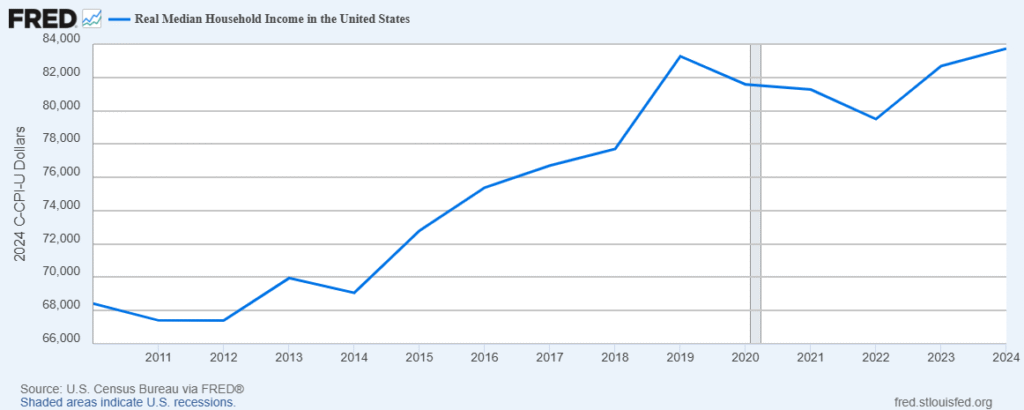

Republican economic policy starts with growth because tight labor markets and investment lift wages fastest. In 2019, real median household income rose across racial groups and all regions, reaching a then-record level before the pandemic shock. That broad-based rise reflected a strong job market, not just top-end gains.

Economists such as Thomas Sowell and Arthur Laffer argue that incentives matter: when after-tax returns improve, capital formation and productivity follow. The Joint Committee on Taxation’s distribution tables for the 2017 Tax Cuts and Jobs Act (TCJA) show tax liability reductions at most income levels, with design elements like a doubled standard deduction and larger child credit benefiting many middle-income filers.

At a glance: Republican growth levers

- Competitive corporate and pass-through tax rates to spur capex

- Permanence and simplicity (fewer cliffs and phaseouts)

- Regulatory streamlining to cut time-to-permit and time-to-market

- Work incentives (e.g., lower marginal rates, smarter benefits cliffs)

Key takeaway: Growth is not a slogan; it is a wage strategy. The most durable way to narrow gaps is to make the pie grow faster so entry- and mid-skill workers see more hours, more options, and better pay.

How Republican economic policy addresses inequality

Inequality has many causes—skills, family structure, geography, and technology among them—so Republican economic policy targets the upstream driver: slow productivity. Faster productivity growth tends to raise real wages and expand opportunity. While critics say “tax cuts help only the rich,” official distributional scoring shows broad incidence of TCJA changes, including middle-class relief. Moreover, 2019 income data recorded widespread gains before COVID-19 and inflation disrupted trends.

Policy implications:

- Pro-investment taxes: Encourage factories, R&D, and small-business expansion that create middle-skill jobs.

- Skills mobility: Make work pay and expand apprenticeships and portable credentials.

- Cost-of-living focus: Expand supply—housing, energy, infrastructure—rather than only subsidizing demand.

Taxes: lessons from JFK, Clinton, and TCJA

Historically, bipartisan episodes back the pro-growth view. The Revenue Act of 1964 cut rates and broadened the base, and the 1997 Taxpayer Relief Act reduced capital-gains taxes and introduced Roth IRAs—moves linked with stronger investment. Republicans cite these precedents to show that growth-minded tax reform is not novel.

Where Republicans stand today

- Make full expensing and R&D expensing permanent to accelerate productivity.

- Lower and simplify marginal rates to reduce complexity and compliance drag.

- Protect family budgets with a stable, inflation-aware tax code.

Nonpartisan scorekeepers (JCT, CBO) do not guarantee growth, of course; they provide incidence and long-run budget views. Even so, the case for competitive rates is pragmatic: capital is mobile, and investment follows incentives.

Infrastructure: build faster, pay smarter

Republicans generally support infrastructure that passes a return-on-investment test and is built faster through regulatory reform and public-private partnerships. The 2021 Infrastructure Investment and Jobs Act earned substantial bipartisan support, reflecting agreement that American logistics need upgrades; the GOP emphasis is on speed, accountability, and cost control.

Why speed matters: Long permitting times inflate costs and deter private capital. Streamlined approvals and standardized design can shave years off project timelines, getting benefits to workers and shippers sooner.

Energy realism: Germany’s energy transition illustrates the risks of over-promising on timelines and under-estimating costs; high electricity prices have pressured industry competitiveness. Republican economic policy favors an “all-of-the-above” energy mix that preserves reliability and affordability while emissions fall through innovation.

Debt and deficits: growth plus restraint

America’s long-term fiscal path is fragile. The CBO projects rising deficits and debt as a share of GDP over the next 30 years, driven mainly by automatic spending growth in major entitlements and interest costs. Republicans argue that both parties contributed to today’s debt and that reform must focus on spending trends while keeping pro-growth incentives in place.

A conservative path to balance:

- Cap and review real spending growth outside defense and core safety nets.

- Modernize entitlements to sustain benefits for the vulnerable while aligning incentives and longevity.

- Grow the base—more workers, more investment, more productivity—so the same tax rates yield more revenue.

This approach mirrors earlier eras when rate reductions paired with base-broadening supported growth (JFK) and when capital-gains relief (1997) coincided with robust investment cycles.

What this means for the middle class

Middle-income families feel the economy through three lenses: the paycheck, the price tag, and the job ladder. Republican economic policy targets all three.

- Paychecks: Competitive taxes and strong demand for labor raise take-home pay.

- Prices: More housing, energy, and logistics capacity lowers living costs.

- Mobility: Tight labor markets create new rungs—promotions, skill stipends, and employer-paid training.

Before the pandemic, real median income set records. That momentum was interrupted by COVID-19 and later inflation, but the lesson remains: sustained growth and flexible markets deliver the broadest gains. Census.gov

Frequently asked questions

Do Republican tax cuts only help the wealthy?

Not according to distributional tables and observed pre-pandemic income data. The JCT shows liability reductions across most income groups under TCJA, and 2019 median income rose across demographics and regions. The wealthy still pay more in absolute dollars, but middle-income households received meaningful relief.

What about inequality—does growth really help?

Yes, over time. Tight labor markets raise wages fastest for lower-skill workers. Growth expands hours and opportunities, while supply-side reforms cut costs for housing, energy, and goods—key drivers of living standards.

Do Republicans oppose infrastructure?

No. They favor infrastructure that delivers returns and faster build times. The 2021 bill passed with bipartisan votes; GOP priorities are accountability, permitting reform, and private-capital leverage.

Is Germany’s energy transition a warning?

It’s a caution on cost, speed, and reliability. Rapid shifts without resilient backups can raise power prices and hurt industry. That’s why Republican economic policy backs innovation and gradualism over mandates that risk price spikes.

How would Republicans reduce the debt?

By pairing spending restraint and program reforms with pro-growth tax and regulatory policy. The CBO’s long-term outlook confirms the need to address automatic spending growth and interest costs.

How to put this policy to work

- Make investment easier: Permanent expensing and R&D expensing encourage factories and equipment upgrades.

- Cut red tape: Set firm timelines for energy and transport permits.

- Build smarter infrastructure: Use standardized designs, public-private partnerships, and rigorous cost controls.

- Lower living costs: Expand energy supply and housing to reduce bills for families.

- Strengthen work and skills: Reduce benefit cliffs and scale apprenticeships and employer-led training.

Suggested reading

- Income and Poverty in the United States: 2019 (U.S. Census Bureau). Broad-based income gains before the pandemic.

- Distributional Effects of the TCJA (Joint Committee on Taxation). Official incidence by income group.

- CBO Long-Term Budget Outlook (2024, 2025 updates). Debt and deficit projections through mid-century.

- Infrastructure Investment and Jobs Act (Public Law 117-58). Bipartisan votes and enactment.

- IEA and U.S. Trade data on Germany. Affordability and competitiveness challenges from high electricity prices.